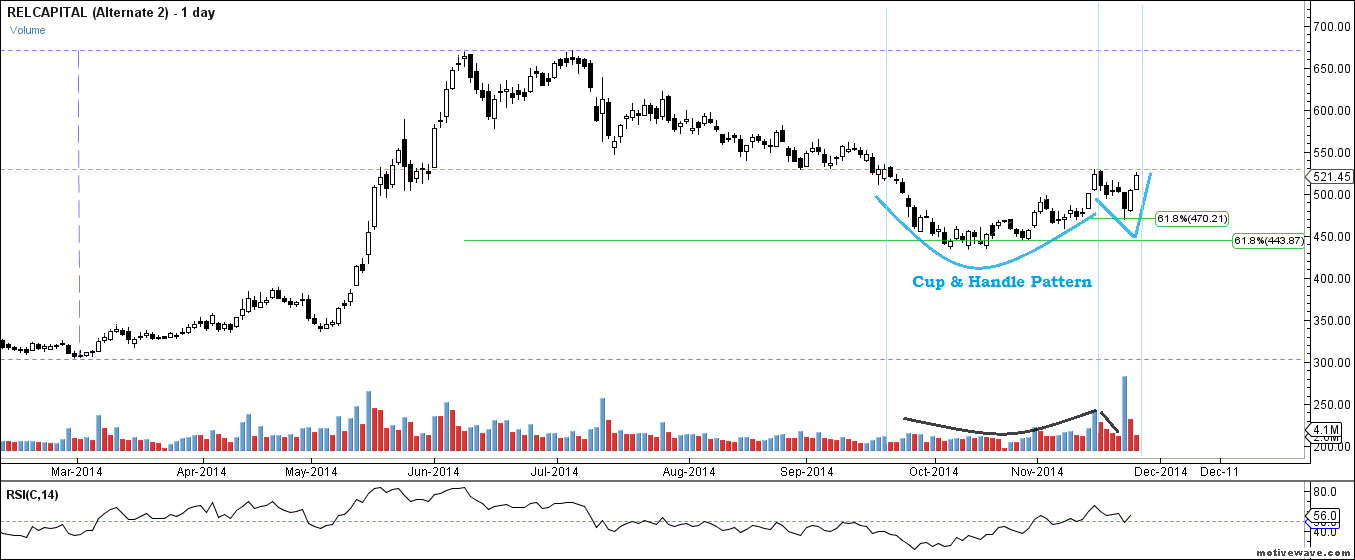

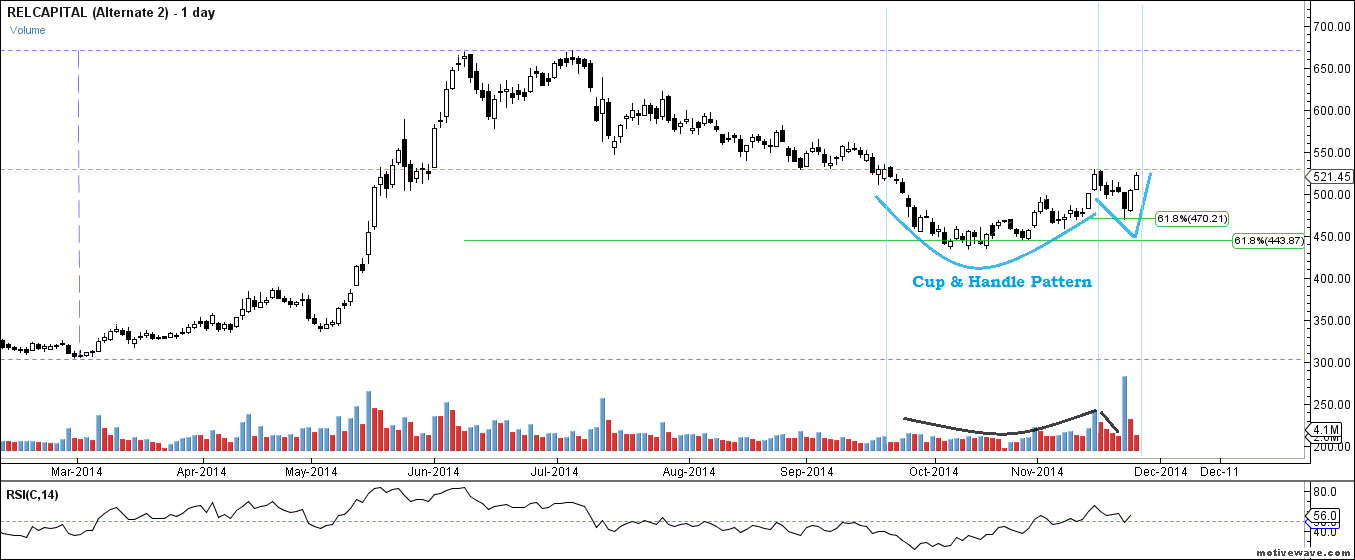

Cup & Handle Pattern is seen on the daily charts of Reliance Capital

.png) |

| Daily Chart |

- Reliance Capital had made a remarkable rally from the level of 300 to 672 , thereafter stock showed a time wise & price wise correction and slightly exceeded 61.8% retracement of this rally however took support at it, forming higher lows shaping into rounding bottom.

- This rounding bottom rally took resistance at previous bottom resistance zone of 528- 530.

- It again slipped into correction and retace about 61.8% of its rounding bottom rally from 433.25 to 528 and bounce therefrom to test the previous resistance at 528.

- It made a cup & handle pattern, which is a Trend reversal pattern & Bullish continuation pattern , examination of which are herein below:

- The top of the cup is formed around levels of 528-530 on 17th September, 2014 and 19th November, 2014 consisting approx 2 month.

- The Bottom of the cup made a low of 433.25 on 13th October, 2014.

- The depth of the bottom is of approx 100 points.

- The stock slipped from the level of 530 which is the previous bottom resistance on 19th November 2014 to the level of 470 which is 61.8% retracement of bottom rally from 430- 530, forming handle consolidation.

- On 26th November, 2014 a rally is seen from this support level & is expected to test previous resistance level of 530.

- A break above 530 could take the stock to the higher levels or a further consolidation may be seen in the range of 470 to 530.

- A break below 470 levels would negate the said pattern formation.

- Volume were curving up during bottom formation, while it dries during handle formation.

.png)

No comments:

Post a Comment